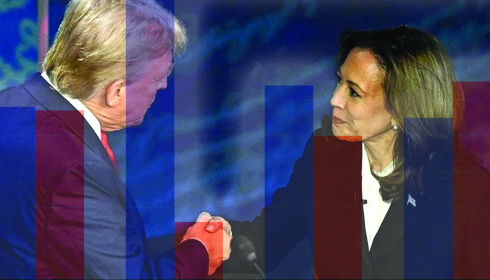

Why Drug Manufacturers Are Leaning Towards Trump Over Harris in the Upcoming US Election?

As the United States presidential election approaches, a distinct division has arisen in the pharmaceutical industry's candidate choices. Former President Donald Trump is gaining favour with major pharmaceutical companies over Vice President Kamala Harris. While Harris pushes for strengthening Medicare's price-bargaining rights under the Inflation Reduction Act (IRA), Trump has taken a different posture, agreeing with corporate interests that oppose major elements of the legislation. Recent legislative changes are fuelling this developing trend, leading pharmaceutical corporations to support Trump, despite Harris receiving substantial campaign contributions from industry players.

Vice President Harris, who cast the critical vote to pass the IRA in 2022, continues to promote strengthening the law's parameters. Harris' agenda includes expanding the $35 insulin limitation and $2,000 out-of-pocket spending limit beyond Medicare users to all Americans, including those with private insurance. Furthermore, her administration would speed up Medicare's drug price discussions, with the goal of covering more drugs faster.

On the other hand, during his administration, Trump initially supported Medicare pricing negotiations. However, his campaign has recently shifted away from this policy. He has joined with corporate lobbyists who see these agreements as "price-setting" tactics, claiming that such rules will restrict R&D spending. Trump's softer posture has resonated with the pharmaceutical sector, which has been vociferous in its opposition to the IRA's price negotiation provisions.

Interestingly, Harris received nearly $5.3 million from the pharmaceutical industry for her 2023-2024 campaign, while Trump received less than $900,000, according to Open Secrets. Despite Harris' financial backing, pharmaceutical executives and industry lobbyists prefer Trump's ideas to Harris' bold measures. Trump's inclination to abrogate major IRA rules, unpopular among sector leaders due to their potential impact on pricing and margins, explains this preference.

Pharmaceutical corporations argue that Harris's ideas, such as Medicare pricing negotiations, could result in reduced R&D spending. The industry has consistently stated that these changes will cause delays in the release of new pharmaceuticals to the market, thus harming patients. Harris' attempts to expand these regulations and control pharmaceutical benefit managers (PBMs) have intensified the industry's worries.

Mark Cuban, who started Cost Plus Drugs, agrees with Harris on PBM disclosure. He has expressed significant support for reducing PBMs' involvement in rising prescription costs, which aligns with Harris' campaign. However, Trump's unwillingness to seek tough PBM rules during his current campaign has strengthened his business support.

While Trump initially supported Medicare price negotiations during his first presidential campaign in 2016, his current programme deviates from that position. The "most preferred nations" language in Trump's 2020 executive order to control medication prices elicited a mixed response from experts. He has subsequently abandoned the plan entirely, siding with PhRMA (the Pharmaceutical Research and Manufacturers of America), the industry's major lobbying organisation, which is opposed to international reference pricing.

Stephen Ubl, PhRMA's president and CEO, commended Trump's focus on lowering prescription costs by targeting PBMs while opposing price-setting initiatives such as the IRA. According to Ubl, Trump's policies "remain more favourable towards market-driven approaches" than Harris' regulatory structure.

Trump's position is further complicated by his involvement with Project 2025, a conservative policy blueprint produced by the Heritage Foundation. While the project proposes removing drug pricing regulations in the IRA, Trump has distanced himself from it. Nevertheless, Harris' team has capitalised on this relationship, warning voters that a Trump presidency might result in the repeal of regulations that cut drug prices for Medicare users.

The pharmaceutical industry's backing for Trump over Harris stems from their differing views on drug pricing and healthcare reform. While Harris advocates for tighter Medicare price negotiations and PBM openness, Trump has distanced himself from these measures, preferring a more industry-friendly approach. The approaching election will determine which approach determines the future of healthcare in the United States, with far-reaching consequences for prescription costs, research funding, and patient access to pharmaceuticals.